Monday's Musing: When The Hunters Become The Hunted

Expect Software Giant Hunters To Soon Be The Hunted In A Digital Giant's Quest For Growth

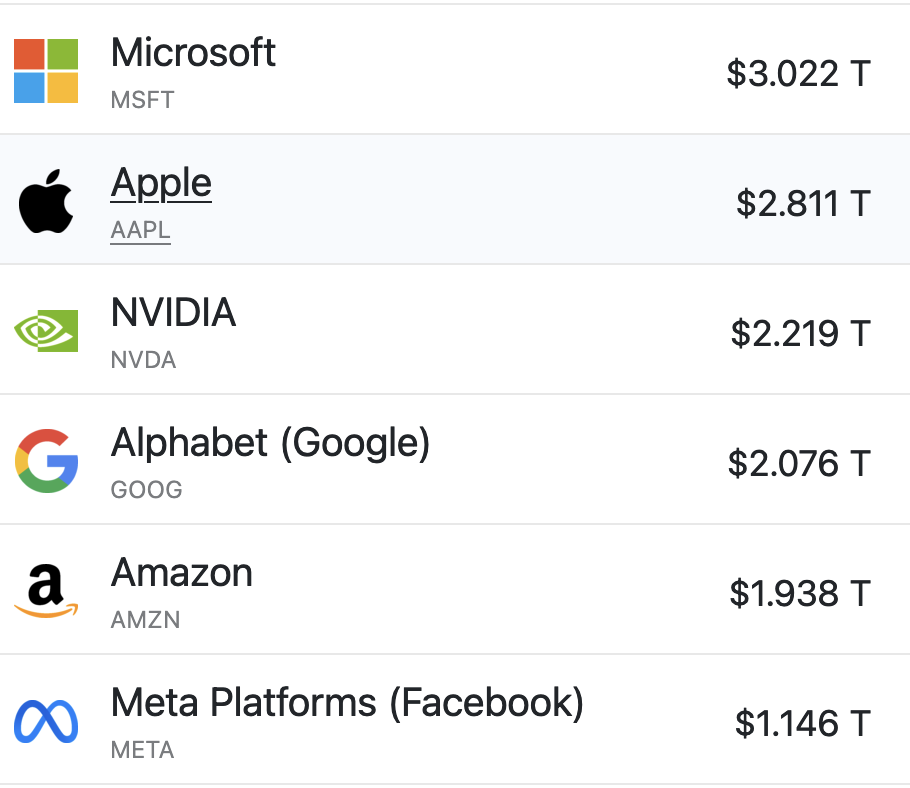

Six of the Magnificent Seven (Microsoft, Apple, Nvidia, Alphabet [Google], Amazon, Meta [Facebook]) stocks have entered the four comma club -over $1 trillion in market cap. With a combined market cap of over $13.2 trillion, these six players continue to defy physics with continuous quarters of double digit organic growth. Digital giants by definition have deployed five key strategies:

- Build the biggest network

-

Own and disintermediate the customer relationship

-

Compete for data supremacy

-

Deploy digital monetization models

-

Take a long term growth mindset

In the enterprise software category, the largest enterprise software vendors are nowhere close to $1 trillion in market cap. In fact, they have a long way to go. Here's their market cap as of May 3rd, 2024

- Oracle $318.27B

- Salesforce $265.45 B

- Adobe $217.80 B

- SAP $214.12 B

- Intuit $176.18 B

- IBM $152.22 B

- ServiceNow $147.18 B

While these software vendors have been seen as the acquirers for quite some time, market conditions could shift quickly making them attractive targets for acquisition by a hungry Digital Giant seeking growth.

Running Out Of Runway For Double Digit Organic Growth Means More M&A In The Future

Should economic conditions take a turn for the worse, the digital giants will have to find inorganic opportunities. Technically digesting companies one-tenth to one-fourth their size would be very possible. In fact, if it weren't for a hawkish anti-trust stance by the current presidential administration, one could expect a faster rate of mergers and acquisitions. Most of the digital giants could find adjacencies to support their growth.

Concurrently, hardware and chip companies such as Broadcom have entered new markets by moving from chips to hardware to software. The next set of players below the trillion dollar market cap club will most likely consolidate in the next three years to gain scale and meet financial targets. With software a highly profitable endeavor, low margin players will likely find themselves drawn to an acquisition of software assets

The Bottom Line: End Of Zero Interest Rates Changes Everything

The end of zero interest rates have shown a confluence of forces in exponential efficiency, AI arbitrage, and margin compression. Each of these factors have transformed market conditions and forced management teams to rethink their business models. As digital giants struggle to achieve double digit growth and maintain their astronomical market caps, inorganic growth may be the only option. Expect a string of strange mergers and acquisitions with a change or presidential administrations in the quest for alpha. New tech conglomerates will emerge to challenge the digital giants. More importantly, new digital giants will emerge to disrupt the incumbents.

Your POV

Where do you see the next set of mergers? Do you think we'll see more bulking up by category or across category?

Add your comments to the blog or reach me via email: R (at) ConstellationR (dot) com or R (at) SoftwareInsider (dot) org. Please let us know if you need help with your strategy efforts. Here’s how we can assist:

- Developing your metaverse and digital business strategy

- Connecting with other pioneers

- Sharing best practices

- Vendor selection

- Implementation partner selection

- Providing contract negotiations and software licensing support

- Demystifying software licensing

Reprints can be purchased through Constellation Research, Inc. To request official reprints in PDF format, please contact Sales.

Disclosures

Although we work closely with many mega software vendors, we want you to trust us. For the full disclosure policy,stay tuned for the full client list on the Constellation Research website. * Not responsible for any factual errors or omissions. However, happy to correct any errors upon email receipt.

Constellation Research recommends that readers consult a stock professional for their investment guidance. Investors should understand the potential conflicts of interest analysts might face. Constellation does not underwrite or own the securities of the companies the analysts cover. Analysts themselves sometimes own stocks in the companies they cover—either directly or indirectly, such as through employee stock-purchase pools in which they and their colleagues participate. As a general matter, investors should not rely solely on an analyst’s recommendation when deciding whether to buy, hold, or sell a stock. Instead, they should also do their own research—such as reading the prospectus for new companies or for public companies, the quarterly and annual reports filed with the SEC—to confirm whether a particular investment is appropriate for them in light of their individual financial circumstances.

Copyright © 2001 – 2024 R Wang and Insider Associates, LLC All rights reserved.

Contact the Sales team to purchase this report on a a la carte basis or join the Constellation Executive Network

R "Ray" Wang

R "Ray" Wang R "Ray" Wang

R "Ray" Wang