Monday's Musings: Ray's Law - Intelligence Is Doubling Every 7 Months

Moore's Law Focuses On Compute, Ray's Law Addresses Growth of Intelligence

In the computing world, Moore’s law stood for 50 years. In 1965, Gordon Moore, one of the co-founders of Intel observed that the number of transistors that coud be placed on a micro chip doubled every two years. This guiding principal for the semiconductor and high tech industry led to Moore's Law where compute doubles every two years.

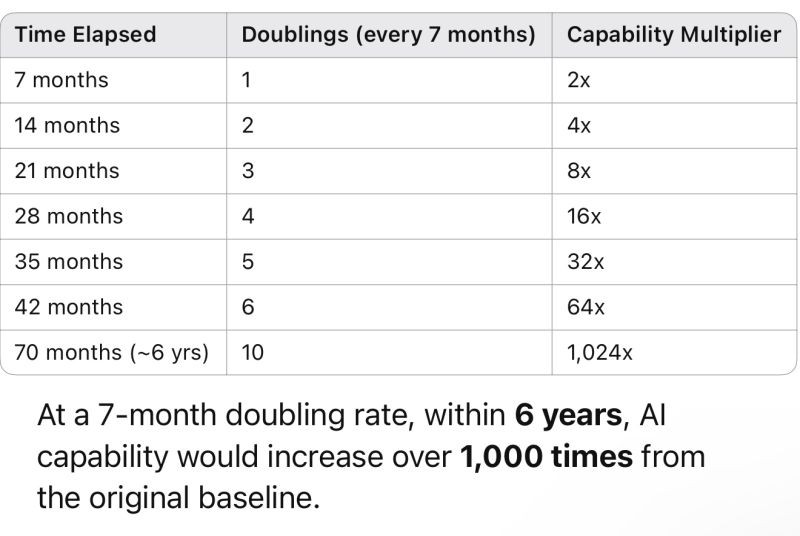

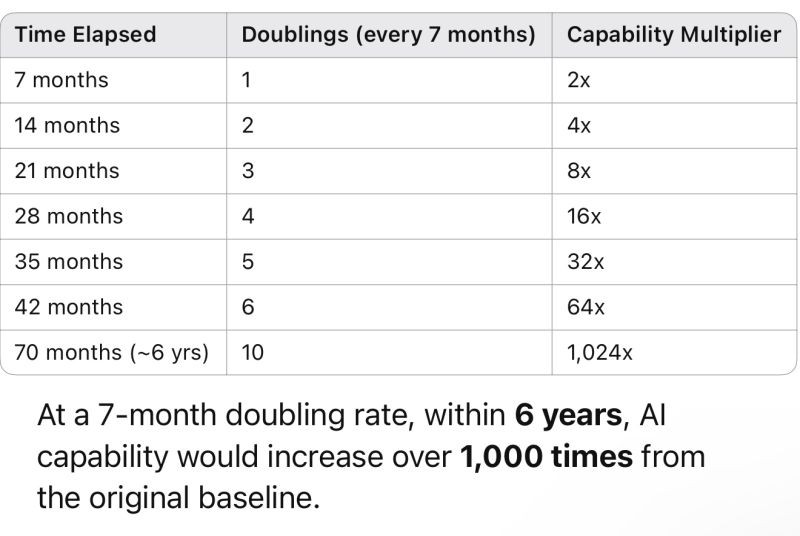

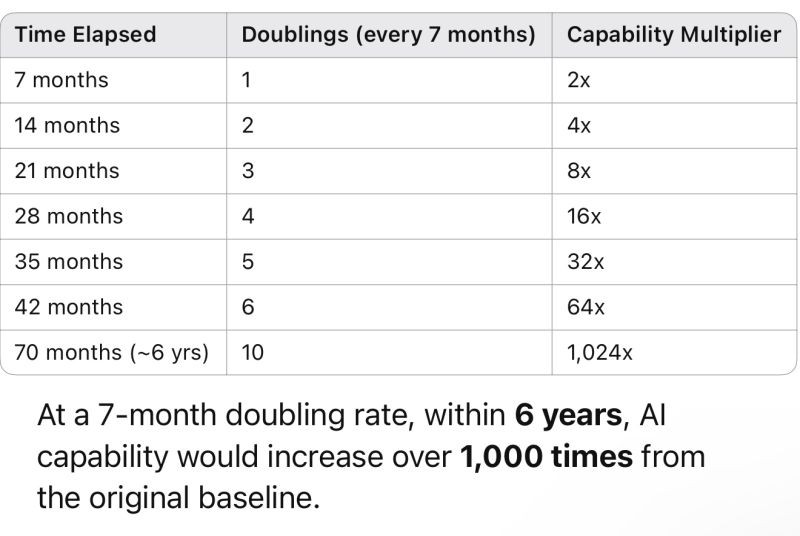

In the Artificial Intelligence world, there's Ray's Law. AI capabilities double every 7 months. At this seven month doubling rate, in two years, this will be a 1500% increase. In six years, AI intelligence capability will be 10,0000%. Credit to David Giambruno for codifying this.

Figure 1. Ray's Law AI Capability Doubling

The Bottom Line

The AI revolution is moving at an exponential pace that will exceed human comprehension. Technology leaders need to shift from linear thinking to geometrical thinking. Investors betting on AI face a once in a generation frameshift in winners and losers

Your POV

Have you made the frameshift to exponential thinking? Will you be ready for AI?

Add your comments to the blog or reach me via email: R (at) ConstellationR (dot) com or R (at) SoftwareInsider (dot) org. Please let us know if you need help with your strategy efforts. Here’s how we can assist:

- Working with your boards to keep them up to date on technology and governance.

- Connecting with other innovation minded leaders

- Sharing best practices

- Vendor selection

- Implementation partner selection

- Providing contract negotiations and software licensing support

- Demystifying software licensing

Reprints can be purchased through Constellation Research, Inc. To request official reprints in PDF format, please contact Sales.

Disclosures

Although we work closely with many mega software vendors, we want you to trust us. For the full disclosure policy,stay tuned for the full client list on the Constellation Research website. * Not responsible for any factual errors or omissions. However, happy to correct any errors upon email receipt.

Constellation Research recommends that readers consult a stock professional for their investment guidance. Investors should understand the potential conflicts of interest analysts might face. Constellation does not underwrite or own the securities of the companies the analysts cover. Analysts themselves sometimes own stocks in the companies they cover—either directly or indirectly, such as through employee stock-purchase pools in which they and their colleagues participate. As a general matter, investors should not rely solely on an analyst’s recommendation when deciding whether to buy, hold, or sell a stock. Instead, they should also do their own research—such as reading the prospectus for new companies or for public companies, the quarterly and annual reports filed with the SEC—to confirm whether a particular investment is appropriate for them in light of their individual financial circumstances.

Copyright © 2001 – 2025 R Wang and Insider Associates, LLC All rights reserved.

Contact the Sales team to purchase this report on a a la carte basis or join the Constellation Executive Network

R "Ray" Wang

R "Ray" Wang R "Ray" Wang

R "Ray" Wang