Trends: What Telco and CSP Leaders Must Consider For 2022

Telcos and CSPs Shift Strategies While Battling The Digital Giants

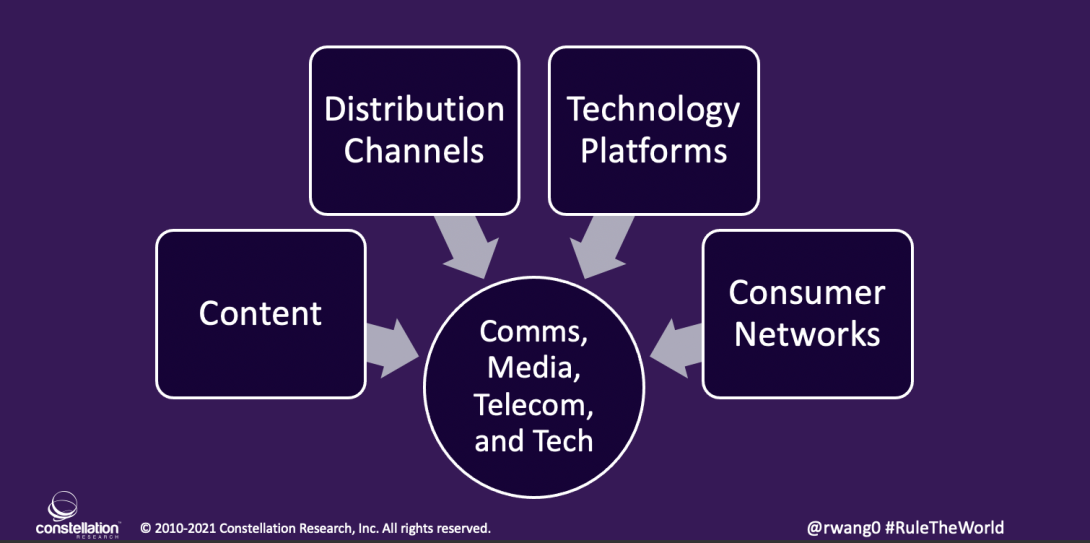

The past two decades has seen a rash of market consolidation activity led by telecommunication organizations in their quest for manifest destiny. The thesis to dominate content, distribution channels, technology platforms, and customer network made sense in the non-digital age (see Figure 1). As these organizations rushed to add content and technology platforms to their portfolios, they began to realize how hard it was to run a content business. Further, post-merger synergies often failed to realize their potential as most organizations could not rationalize how to run businesses with different business and monetization models.

Figure 1. The Four Forces Driving Telecom, Media, Entertainment, and Tech Convergence

Source: R Wang and Insider Associates, LLC

Consequently, the post 5G era has telco’s and CSP’s doubling down on what they know best – infrastructure, the distribution channels and technology platforms used to power the 5G revolution. Why? Well capitalized digital giants in the streaming space such as Netflix and Amazon have created a war for content spending tens of billions each year for content. Unfortunately, Telco’s are not equipped financially for this type of war for top shelf content creation. Hence the divestiture of content by leaders such as AT&T and Verizon while digital giants continue to make acquisitions for content libraries.

Thus the age of vertical integration has ended. Most Telcos and CSPs have exited the content business to focus on distribution networks. The few that remain vertically integrated have adopted a digital giant posture and will choose to identify long term investors aligned with this vision.

Leaders Must Prioritize Trends Based On The Business Hierarchy Of Needs

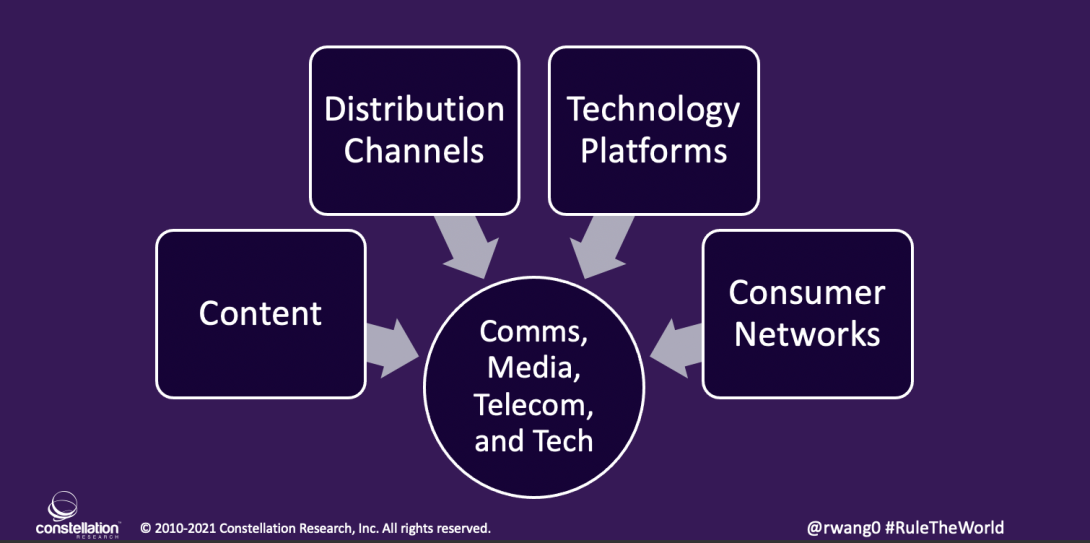

As telcos and CSPs double down on infrastructure, the renewed focus has led to trends that align with the business hierarchy of needs. This model enables leaders to prioritize business strategy (see Figure 2). As many know, Maslow’s hierarchy of needs provided a framework to assess needs and wants at the individual level. While Maslow's research explained what would drive and motivate individuals, applying the model to organizations yields a powerful framework for business prioritization. Why? Today's next gen C-level executives face an onslaught of business priorities that must address the organization's basic needs from regulatory compliance to higher level needs that include the management of the brand. The business hierarchy of needs uses an analogous framework to Maslow's. Using the framework, business priorities and related projects can be aligned with the five levels that include:

- Brand. The brand describes a promise to stakeholders. The brand is more than the collection of products or services offered by the company. The brand encompasses an emotional value, an aspiration, and the public face of a business strategy. The brand can be viewed as a person, product, organization, and symbol for the company.

- Strategic differentiation. Organizations seek strategic differentiation to achieve a desired reputation, create a defensible competitive advantage, and influence preferential behaviors in the value chain. Tools include positioning strategy, design thinking, and innovation programs.

- Revenue growth. Revenue growth reflects the initiatives used to drive new customers, revenues, and market share for the organization. Revenue growth is also known as top line priorities.

- Operational efficiency Operational efficiency priorities focus on reducing costs, improving existing performance, and optimizing existing landscapes. Operational efficiency is also know as bottom line priorities.

- Regulatory compliance. Regulatory compliance is a base need. Organizations must comply with legal requirements. In addition, organizations may want to avoid legal suits, causing injury, or failing to meet a commitment.

Figure 2. Constellation's Business Hierarchy Of Needs

Source: Constellation Research, Inc.

In the Post 5G Era, Trends Reflect An Asset Heavy Environment Aligned To The Business Hierarchy Of Needs

The push back to 5G investment and rollout has most organizations focused on reinvestment into the distribution network and technology platforms. Constellation estimates that this market will exceed $100 billion in revenues by 2030. Conversations with over 121 telco and CSP leaders highlight the following trends for 2022:

Regulatory compliance

- Increasing complexity and volume of regulations. An onslaught of global regulations continue to challenge providers. Leaders see a massive push towards software based solutions, analytics, automation, and AI to address compliance. Greater focus on automation will provide a 10x efficiency for early adopters.

- Proactive reduction of risk. Organizations seek to prevent unnecessary risks, reduce data entry errors, and proactively identify and prioritize potential risks. Risk management moves from reactive to proactive. Software and digital strategies provide the scale required to mitigate risk.

- Heightened awareness of cybersecurity threats. As attack surfaces increase and multiply, leaders must take intelligent approaches to both assessing and addressing threats. Full back up and disaster recovery along with new security techniques ensure that critical infrastructure is protected. The move to the cloud will off load some issues to cloud providers.

Operational efficiency

- Greater investments in predictive asset management. In the drive for greater operational efficiency, a push for predictive asset management enables the optimized utilization of highly expensive capital investments. Leaders must move from sweating assets to improving execution capacity. AI will play a greater role in improving deployment of capital.

- Convergence of asset performance management (APM) and field service management (FSM). Organizations must bring together their APM systems with their field service to achieve exponential gains to drive efficiency. Linking APM with FSM together enables better up-stream and down-stream sensing as well as greater visibility into the lifecycle of an asset.

Revenue growth

- Delivery of subscription models. Customers expect providers to deliver on new subscription models. They expect to remove themselves from the shackles of ownership and move towards freedom and flexibility with usership. Granularity of services, quality of service (QoS), and ease of purchase drive subscription strategy.

- Focus on post sales revenue. The shift from equipment based revenue to services based revenue has arrived. Installation, support, and warranty revenues are now aligned with equipment sales and experience based services. Organizations must identify, create, and deliver new offerings in shorter and shorter life cycles.

Strategic Differentiation

- Using IOT to improved experiences. The connected world via internet of things (IOT), provides more opportunities to use data to deliver on improved experiences. By providing contextual relevance, telcos and CSPs can understand existing usage patterns, anticipate future needs, and improve each interaction.

- Delivering on digital transformation. Every organization must move beyond digital channels to delivering on new business models and monetization models. This requires a rethink of partner ecosystems and investment into adjacent startups. Organizations must also support the cultural change required by addressing needs for dynamic skills and continuous learning environments.

Brand

- Alignment with ESGs. Activists continue to shame corporations who have not taken a stance on environmental, social, and governance requirements. Leaders must determine their positions on each of these goals.

- Purpose driven brand. As leaders align their brand with authentic actions, the transmedia story-telling to support authentic actions increases in importance. Every brand is now a media company and every brand is responsible for their community. Top brands will activate movements.

The Bottom Line: Use The Business Hierarchy Of Needs For Business Prioritization

As with Maslow's framework for motivation, the business adaptation delivers a framework for all c-level execs to:

- Align projects and priorities using the five categories in the framework

- Budget resources, funding, and investments in a portfolio management model by type of business need

- Craft a strategy and portfolio mix based on business models and business need

- Develop a methodology to include in overall corporate strategy

- Evaluate with regular frequency for opportunities to improve

My book, "Everybody Wants to Rule the World," starts here with DDDNs and ends with winning in the age of the new monopoly. Available for pre-order now

Your POV

Are you a telecom, media, entertainment, or tech company seeing this convergence? Are you ready for the big trends in 2022? Now's the time to prepare!

Add your comments to the blog or reach me via email: R (at) ConstellationR (dot) com or R (at) SoftwareInsider (dot) org. Please let us know if you need help with your AI and Digital Business transformation efforts. Here’s how we can assist:

- Developing your digital business strategy

- Connecting with other pioneers

- Sharing best practices

- Vendor selection

- Implementation partner selection

- Providing contract negotiations and software licensing support

- Demystifying software licensing

Reprints can be purchased through Constellation Research, Inc. To request official reprints in PDF format, please contact Sales.

Disclosures

Although we work closely with many mega software vendors, we want you to trust us. For the full disclosure policy,stay tuned for the full client list on the Constellation Research website. * Not responsible for any factual errors or omissions. However, happy to correct any errors upon email receipt.

Constellation Research recommends that readers consult a stock professional for their investment guidance. Investors should understand the potential conflicts of interest analysts might face. Constellation does not underwrite or own the securities of the companies the analysts cover. Analysts themselves sometimes own stocks in the companies they cover—either directly or indirectly, such as through employee stock-purchase pools in which they and their colleagues participate. As a general matter, investors should not rely solely on an analyst’s recommendation when deciding whether to buy, hold, or sell a stock. Instead, they should also do their own research—such as reading the prospectus for new companies or for public companies, the quarterly and annual reports filed with the SEC—to confirm whether a particular investment is appropriate for them in light of their individual financial circumstances.

Copyright © 2001 – 2021 R Wang and Insider Associates, LLC All rights reserved.

Contact the Sales team to purchase this report on a a la carte basis or join the Constellation Executive Network

R "Ray" Wang

R "Ray" Wang R "Ray" Wang

R "Ray" Wang