Contactless, Direct To Consumer, Buy Online Pickup Anywhere, Automation, and Subscription Ready Drive Post Pandemic Response

Matrix Commerce analyzes the disruptive pressures influencing the commerce paradigm. Commerce faces rapidly changing business models and new payment options that are often misunderstood and poorly integrated.

Matrix commerce (TM) means the fusing of demand signals and supply chains in an increasingly complex world where buyers seek frictionless buying experiences. Friction in this new world originates from new regulatory requirements such as sustainability, taxation, and privacy.

As commerce continues to evolve around buyer preferences, channels, demand signals, supply chains, payment options, enablers, and big data will converge to create Matrix Commerce. Matrix Commerce spans across disciplines as people, process, and technologies continue to transform today's commerce models.

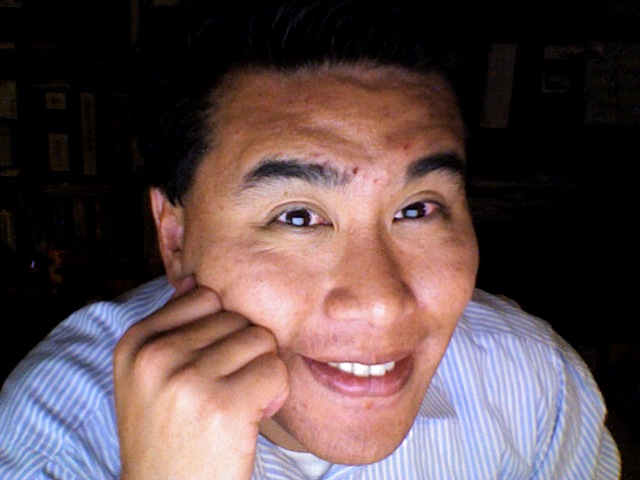

Constellation has seen significant push for direct to customer, contactless commerce, buy online pick up curbside, digitization of channels, subscription and services ready, and automation and AI enablement. Conversations with matrix commerce business and technology leaders have led to 12 key trends in the post pandemic world:

R "Ray" Wang

R "Ray" Wang R "Ray" Wang

R "Ray" Wang