Event Report: Microsoft's Worldwide Partner Conference 2012 #wpc12

Microsoft Provides The Passion And Products For Partners To Compete In A Post PC Era

Microsoft kicked off its Worldwide Partner Conference in Toronto, Canada amidst 16,000 partners (See Figure 1). Attendees caught the latest news and product announcements while sharing new business models and products for a post PC era. Key announcements for Day 1 and Day 2 include:

- Partners given back the relationship in Office 365. Partners gain a pre-paid payment option with Office 365. The service gives partners a mechanism to deliver "packaged services with a single invoice and manage the customer relationship”.

Point of View (POV): Partners have been clamoring for the ability to manage the customer relationship in the cloud. Microsoft proves it's allegiance to partners by providing Office365 Open and reasserts that Microsoft will not disintermediate the partner channel

- Windows 8 RTM/GA dates confirmed. Corporate VP of Windows Tami Reller announced that Windows 8 is on track for an early August release to manufacturers (RTM) and generally available (GA) at the end of October. Enterprise customers will receive Windows 8 as early as August. The product is available in 109 languages and 231 markets. Consumers can expect to receive Windows 8 by software upgrades and device purchases by end of October.

Point of View (POV): Windows 8 is the most tested release in Microsoft history. Reller showed demos from Acer, ASUS, HP, and Lenovo of upcoming tablets, Ultrabooks, PC's, and hybrid tablets, highlighting the broad and deep offerings available this fall. Microsoft may have cracked the code in better release coordination with Windows 8. Unfortunately, with Windows 7 momentum strong at 630M worldwide, the conversion to Windows 8 may take a bit longer as users have just gotten used to 7.

- Perceptive Pixel (PPI) acquisition highlights importance of touch. Kurt DelBene, President of the Office division announced the acquisition of PPI. The company is best known for its 82" collaborative multi-touch screen used by CNN during the 2008 elections. While terms of the deal were not disclosed, the devices have dominated the high end at $80,000 a unit. Perceptive's founder Jeff Han was on stage with a trademark demo highlighting the collaborative and interactive features of the product.

Point of View (POV): Should Microsoft succeed in driving down the cost of PPI's flagship display technology, the Office division will have a focal point for discussion around the future of work. PPI's technologies have shown leadership in multi-touch user experiences and digital content display technologies. Partners and customers can expect these innovations to quickly make their way into Windows Phone 8.

- New apps take storm on Windows Phone 8. Attendees saw the power of integration with Windows Phone 8 and Windows 8. A lineup of new business apps include Words with Friends, Draw Something, Audible, Chase and PayPal. On the game front, new titles include Asphalt 7: Heat, N.O.V.A. 3: Near Orbit Vanguard Alliance, and Batman: The Dark Knight Rises ”

Point of View (POV): While not as robust as the Apple iStore, new titles and a growing developer ecosystem on multiple device types gives Windows Phone 8 a compelling chance. With RIM and Nokia on life support, Microsoft has a shot to earn its place as a platform of choice. The challenge - emphasize the interoperability between devices and prove the write once deliver any device mantra. If Microsoft executes, Android will emerge as their number one competitor and appear as a messy platform when compared to Windows Phone 8.

- ISV's select Microsoft Dynamics as their core platform. Microsoft expands its presence as the core platform for several new independent software vendors. Campus Management Corp., Cenium, Inc., Cincom Systems, Inc., PROS Pricing and Technosoft join the growing list of vendors building on the Dynamics platform. Other notable members include Tyler Technologies and Ferranti Systems MECOM product.

Point of View (POV): The move to open up the Dynamics platform is brilliant. ISV's with deep industry vertical capabilities can cut their development costs by up to 1/3. Instead of focusing on building out the platform, the savings can go towards furthering the last-mile solution. The catch - ISV's become wedded to the success and failure of Microsoft Dynamics.

Figure 1. Scenes From WPC12

The Bottom Line: New Partner Types Will Emerge

The world of resellers, ISV's, OEM's, solution partners, and system integrators have converged. Every partner type must face the new realities:

- Cloud disintermediates the customer relationship and delivery

- Products are excuses to sell services. However, services are now an excuse to sell information

- Customers want turnkey solutions from one source to choke

- Deep vertical capabilities drive profitability

- Innovation is no longer a luxury

- Everyone is in everyone's business

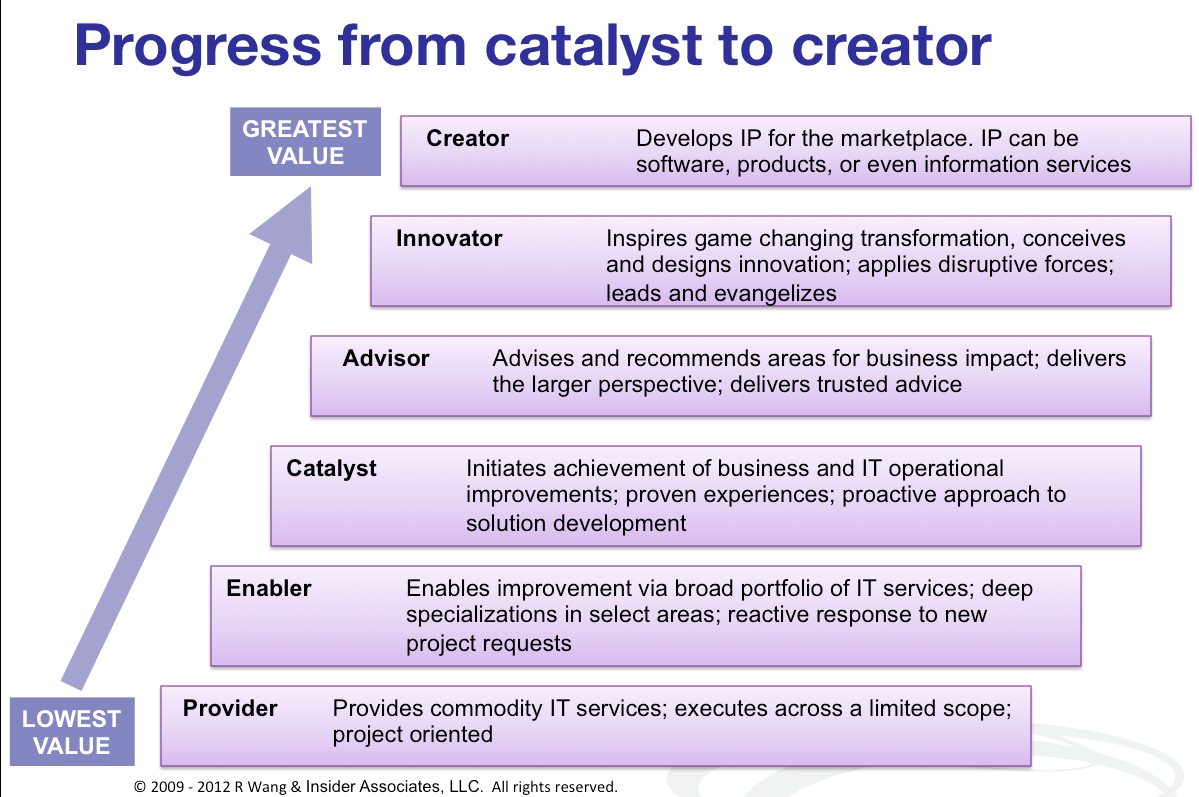

As a result, partners have made the value shift from provider to catalyst over the past 3 years (see Figure 2). Leading partners have moved to a trusted advisor status. Unfortunately, these activities are not enough. Partners must start delivering intellectual property (IP) if they plan to thrive. Why? Customers are willing to pay a premium for last-mile innovative solutions from a trusted partner. With the overall commoditization occuring in the ecosystem, new revenues will come from IP. If a partner can deliver this in the cloud, that partner will have the ability to massively monetize across the entire ecosystem.

Figure 2. Partners Must Shift To The IP Creation Achetype To Thrive

Your POV

Microsoft Partners, ready to transform from Catalyst to Creator? What’s your view the outlook for Microsoft and your customers? Ready to embrace Dynamics Platform, Windows 8, Office 365, and Azure? Looking? Add your comments to the discussion or send on to rwang0 at gmail dot com or r at softwaresinsider dot org and we’ll keep your anonymity.

Resources And Related Research:

- 20120508 Constellation Researh - R"Ray" Wang "The Link Between Certification and Partner Profitability"

- 20100711 A Software Insider's POV - R "Ray" Wang - "Research Report: Microsoft Partners – Before Adopting Azure, Understand the 12 Benefits And Risks"

- 20100621 A Software Insider’s POV – R “Ray” Wang – “Research Report: How SaaS Adoption Trends Show New Shifts In Technology Purchasing Power”

- 20090714 Sandhill.com – R “Ray” Wang – “Opinion: Moving to a SaaS Offensive”

- 20100322 A Software Insider’s POV – R “Ray” Wang -”Understanding The Many Flavors Of Cloud Computing/SaaS”

- 20100125 A Software Insider’s POV – R “Ray” Wang – “Monday’s Musings: The Hidden Value In SaaS Deployments”

- 20091222 A Software Insider’s POV – R “Ray” Wang “Tuesday’s Tip: 10 Cloud And SaaS Apps Strategies For 2010″

- 20091208 A Software Insider’s POV – R “Ray” Wang – “Tuesday’s Tip: 2010 Apps Strategies Should Start With Business Value”

- 20091012 A Software Insider’s POV – R “Ray” Wang – “Research Report: Customer Bill of Rights – Software-as-a Service”

- 20090602 A Software Insider’s POV – R “Ray” Wang ” Tuesday’s Tip: Now’s The Time To Consider SaaS Software Escrows”

- 20081028 A Software Insider’s POV – R “Ray” Wang “Tuesday’s Tip: SaaS Integration Advice”

Reprints

Reprints can be purchased through Constellation Research, Inc. To request official reprints in PDF format, please contact Sales .

Disclosure

Although we work closely with many mega software vendors, we want you to trust us. For the full disclosure policy, stay tuned for the full client list on the Constellation Research website.

* Not responsible for any factual errors or omissions. However, happy to correct any errors upon email receipt.

Copyright © 2001 – 2012 R Wang and Insider Associates, LLC All rights reserved.

Contact the Sales team to purchase this report on a a la carte basis or join the Constellation Customer Experience!

R "Ray" Wang

R "Ray" Wang R "Ray" Wang

R "Ray" Wang