News Analysis: Crypto FOMO and Bitcoin's Rise Into the $1 Trillion Club

Crypto FOMO Drives Capital Flows Out Of Big Tech (For Now)

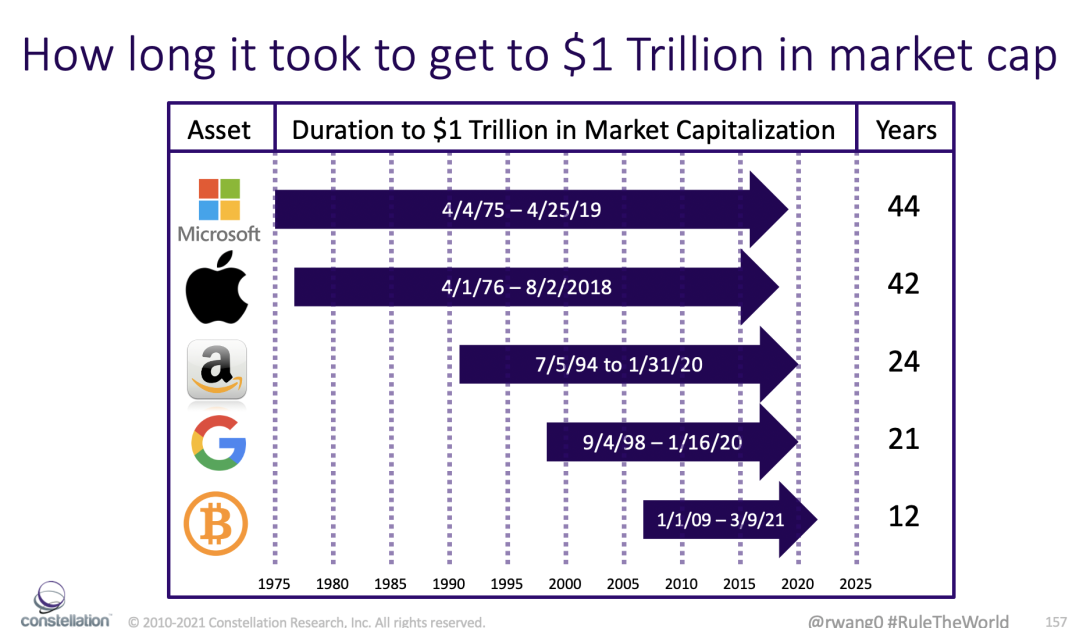

Retail investors have taken money out of the equity market and rotated into crypto to catch the wave. With all crypto's now worth more than $2 Trillion in market cap and Bitcoin standing out at $1 trillion, this poses a risk to the US dollar dominance as the reserve currency.

- Bitcoin ($57,000), $1T market cap

- Ethereum ($3,491), $404 B market cap

- Binance Coin ($643.74), $98 B market cap

- Dogecoin ($.597), $77 B market cap

- XRP ($1.67), $75 B market cap

- Tether (.9999) $53 B market cap

- Cardano ($1.63) $52 B market cap

The current rush into crypto and NFT's creates a casino atmosphere and "gold" rush into the next big thing. Only a few crypto assets will survive in the long run. Bitcoin's finite limit of 21 million coins, Ethereum's role in commerce, and Cardano seem to have the best prospects. Expect this trend to continue into the summer and taper off as the reopen rotation gains traction.

The Bottom Line: Don't Count Big Tech Out

The first quarter of 2021 showed how the digital giants continued to grow at break neck paces. While stock prices reflect a reopen rotation and crypto FOMO trend, few asset classes can show this type of year over year performance. Don't count big tech out. Big tech should remain a key component in portfolios. However, not all big tech stocks are created equal. Only the digital giants will continue to create competitive moats, invest in innovation, and play the long term game of global domination.

For the year:

- Google up 30%

- AirBnB up 22.68%

- Oracle up 17.42%

- IBM up 13.93%

- SAP up 11.16%

Buying big tech stocks on the dip have often boded well for the long term investor. Tesla, Apple, and Amazon are currently under performing for the year but have long term upside and most likely may be undervalued in the past week. Take note, Honeywell's entry into the NASDAQ reflects how the company's portfolio is geared for more growth with Quantum Computing and Connected Buildings.

Get the latest book Everybody Wants To Rule The World

Your POV

Are you in the repoen rotation or the crypto FOMO? What are you investing in next? Ready to find the next set of digital giants?

Add your comments to the blog or reach me via email: R (at) ConstellationR (dot) com or R (at) SoftwareInsider (dot) org. Please let us know if you need help with your AI and Digital Business transformation efforts. Here’s how we can assist:

- Developing your digital business strategy

- Connecting with other pioneers

- Sharing best practices

- Vendor selection

- Implementation partner selection

- Providing contract negotiations and software licensing support

- Demystifying software licensing

Reprints can be purchased through Constellation Research, Inc. To request official reprints in PDF format, please contact Sales.

Disclosures

Although we work closely with many mega software vendors, we want you to trust us. For the full disclosure policy,stay tuned for the full client list on the Constellation Research website. * Not responsible for any factual errors or omissions. However, happy to correct any errors upon email receipt.

Constellation Research recommends that readers consult a stock professional for their investment guidance. Investors should understand the potential conflicts of interest analysts might face. Constellation does not underwrite or own the securities of the companies the analysts cover. Analysts themselves sometimes own stocks in the companies they cover—either directly or indirectly, such as through employee stock-purchase pools in which they and their colleagues participate. As a general matter, investors should not rely solely on an analyst’s recommendation when deciding whether to buy, hold, or sell a stock. Instead, they should also do their own research—such as reading the prospectus for new companies or for public companies, the quarterly and annual reports filed with the SEC—to confirm whether a particular investment is appropriate for them in light of their individual financial circumstances.

Copyright © 2001 – 2021 R Wang and Insider Associates, LLC All rights reserved.

Contact the Sales team to purchase this report on a a la carte basis or join the Constellation Executive Network

R "Ray" Wang

R "Ray" Wang R "Ray" Wang

R "Ray" Wang